10 Powerful eCommerce Data Collection Strategies & Examples

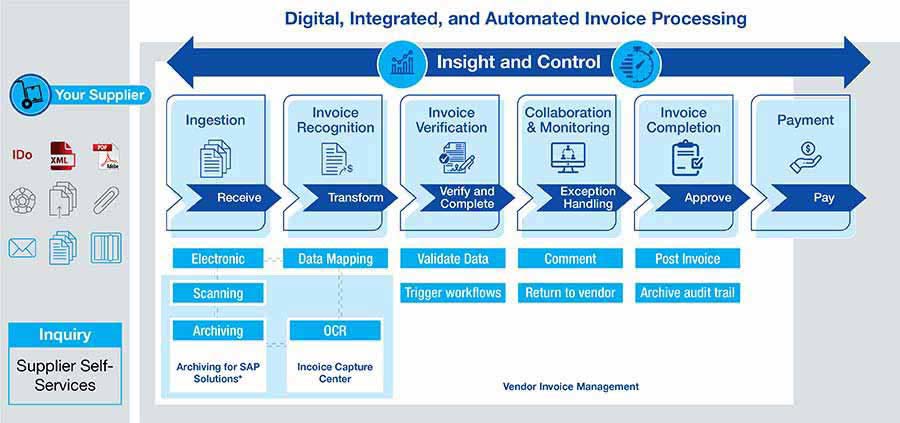

A technology and automation approach to invoice management strengthens vendor negotiating power, improves cash flow visibility and frees up expensive F&A resources which can transition to higher value strategic activities.

An Office of Inspector General (OIG) audit showed the U.S. Environmental Protection Agency (EPA) risking close to $1.2 billion of taxpayer funds by using manual invoice processing. This outdated system not just deprived EPA of prompt payment discounts, but also invited interest penalties and crippled performance of critical duties. Manual processing also made EPA non-compliant to federal laws, regulations and agency policies.

Automating the invoice processing saves a lot of time and money, creates efficiencies and increases the accuracy of data captured from invoices.

Enterprises receiving invoices from suppliers in paper form, email, fax, mails and in various electronic formats is not a new thing. Nor are the challenges these invoices pose.

90% of business data, transactions and records are in an unstructured format and nowhere is this more prominent than within the Accounts Payable department. – Gartner

Streamline cumbersome invoice processes by automating systems.

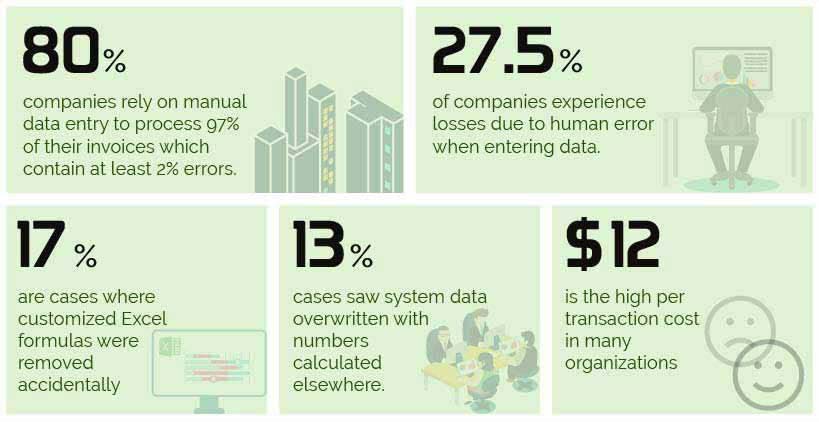

For companies manually handling invoice data, technology presents a huge opportunity to improve efficiency and reduce operational costs by automating the end to end accounts payable process. Especially when machine learning (ML) and robotic process automation (RPA) are radically and positively changing the way document are processed.

Accurately processed invoice data provide better insights to strengthen organizational negotiating power and build credibility. Businesses are better equipped to partner with major suppliers to share risk, extend payment terms and increase warranty periods.

A pharmaceutical company in Switzerland implemented automation and realized ROI in less than two months and a 90% improvement in overall processing time was achieved, by using automation to reduce process complexities and strengthen corporate cost management. The workflow for inbound collection of invoices from across multi-functional printers (MFPs), scanners, fax, e-mail and other electronic systems was standardized and automated.

The company used ML and AI to identify vendors. Based on this intelligence, invoices were sorted and routed to concerned departments for approvals. This not only eliminated the need to sort the documents before they were processed but significantly reduced errors and delays.

When a media Moghul from Switzerland automated credit note processing, there was 100% reduction in manual efforts, 60% improvement in the processing time and the accuracy of their invoice data skyrocketed. The company realized its ROI in just 3 months. So how did this happen?

A building material supplier in the UK achieved 100% compliance on TAT SLA and a 54% reduction in workforce when all group companies and regional offices of a building material supplier in the UK achieved routing of accurate, verified invoices to target audiences as scheduled, according to pre-determined criteria.

Customized computation and attended bots were used to implement rules such as:

A German HR service provider improved processing speed of invoiced by 75% while reducing manual efforts and overall costs by 10% and 60% respectively. They were initially challenged with implementing a decentralized invoice process while retaining the centralized framework and policies. All approving authorities of the multiple group companies and regional offices needed their own customized approval workflows.

The company improved processing speed by 75%, while reducing manual efforts and overall costs by 10% & 60% respectively. Recovered the cost associated with automation within 3 months of implementation. So how did the company manage this?

A leading German accounting service provider looking to strengthen market credibility adopted automated invoicing to ensure immediate payment of invoices on arrival. Easy access to accurate invoice data allowed both finance teams and management to get a clear picture of the transaction and the related vendor. This facilitated prompt and informed business decision. It improved vendor experience in the market, positively impacting goodwill. Automated invoice processing turned the tables, and they:

The processed invoices were stored in a secured digital archive directly connected to the AP system enabling authorized users to search, retrieve and access invoices from any browser. The archive also supported reporting and audits that could be tied to a records management system for document disposition at appropriate time.

Automation and process improvement in invoice processing will enhance the accuracy of cash flow forecasts, position the business to improve liquidity, mitigate potential funding gaps and deliver higher profits.

Invoice processing, though essentially a core operational function is often viewed as a non-exciting back-office activity by many organizations. Businesses hence often neglect this function while developing strategies to grow or build competitive advantage. Without managing invoice processing effectively, enterprises can easily lose value on their team’s effort, mistakenly cost the company literal money, or even damage their professional relationships. Its time businesses take a more strategic approach towards automating invoice processing.

What’s next? Message us a brief description of your project.

Our experts will review and get back to you within one business day with free consultation for successful implementation.

Disclaimer:

HitechDigital Solutions LLP and Hitech BPO will never ask for money or commission to offer jobs or projects. In the event you are contacted by any person with job offer in our companies, please reach out to us at info@hitechbpo.com

Leave a Reply