How Human Data Annotations Shape Generative AI

Leveraging bots and RPA for data extraction from mortgage documents accelerates loan processes and enhances lender’s ability to process voluminous documents.

Digitization is changing the way mortgage industry operates, empowering it to recognize critical competencies, performance metrics, and measures for process improvement. The number of non-traditional lenders is fast increasing. In the US alone they account for 37% of total mortgage originations. And these modern-day lenders demand fast loan processing.

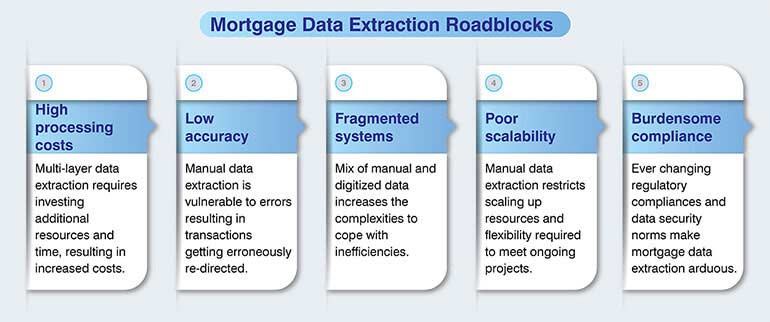

Mortgage data extraction calls for automation to address key pain points such as compliance and document security; technology lags and customer experience. It is an imperative for mortgage lenders seeking to accelerate their mortgage processes.

Around 90% of C-suite executives are interested in leveraging technology to streamline data extraction for mortgage processing. Reducing errors, achieving shorter cycle times, and optimizing costs are the reasons why mortgage companies are opting for automated loan data extraction.

Automated capture of 700K property records per month from 500 US counties helped a leading real estate data aggregator update its property data pool in real-time. The data, primarily from Mortgage documents, enhanced customer experience and engagement.

Read how →

Automating processes addresses the inherent challenges associated with mortgage data extraction. Some of the benefits of automated mortgage data extraction have been discussed below.

A loan providing company, upon implementing automation, increased productivity 300% without any increase to the size of their staff. They successfully reduced file review time by one third; from 24-48 hours compared to the 3-7 days previously. Manual processing restricted them to handle just over 300 loans per month; but automated document processing increased it to nearly 1000 loans in a month. Built-in reporting capabilities to track and evaluate productivity metrics is the added advantage of automated process they enjoy.

Source: loanlogics.com

Professionals constantly dealing with mortgages should essentially have an in-depth understanding of the implementation workflow to assess the benefits in your business context. Summarized below are important steps to a robust automated data extraction ecosystem for your mortgage processing tasks.

Bots classify mortgage and loan application, credit reports, billing statements, insurance and tax documents in valid category before the data extraction begins.

Leveraging technology and tools reduces time required for classification of mortgage documents across data extraction stages. Artificial Intelligence (AI) based bots index and classify structured as well as unstructured documents into different categories in a highly secured environment.

Implementing automated data extraction helped US-based online-lender, handle a targeted volume of 100K+ documents per month, with 90% plus accuracy. The Machine Learning – ML backed algorithms improved the processing speed by 10 times and reduced the cost up to 70%.

Source: bisok.com

AI-bot led mortgage documentation classification framework:

Irrespective of you leveraging automated data extraction, errors can creep in, and you must not let them go undetected and grow greater in magnitude. But how to detect inconsistencies?

Creating and setting macro rules is essential to prevent common inconsistencies during data capture. Rules allow your automation initiatives to mature and enhance your AI-capabilities. This is especially important when you are aware about dynamics of different mortgage types.

Create robust rule-based mechanisms that quickly reveal inconsistencies – errors, missing values etc. – and trigger alerts. Rules must take into consideration mortgage types and the stringent conditions they involve.

Rule-based mechanism to detect inconsistencies across mortgage types:

Want to handle volumes of mortgage document swiftly and accurately?

Mortgage process involves complex set of documents, and not each of them have neatly printed texts. Documents contain illegible handwritings, signatures and even stamps. So, sole reliance on a single data capture technology doesn’t help.

Have a combination of data-capture technologies as a part of your resource pool, which you must keep dynamic, bettering and adding technologies from time-to-time.

Optical Character Recognition (OCR) for simple-to-interpret documents like:

Intelligent Character Recognition (OCR) for complex documents like:

Magnetic Ink Character Recognition (MICR) is the best way you can capture details from bank statements and cheques.

Document abstraction is critical to the entire data extraction workflow; especially when legal or financial information is being reviewed. Automated mortgage document abstraction built using Natural language processing (NLP) can allow you to streamline the abstraction process.

Technology backed document abstraction:

Data extraction is complete only when extracted data is duly verified and validated. Reliable mechanism to understand the legalities of mortgage processing is imperative. Once data is plugged into the database into respective fields across different tables; assess what percentage of information is extracted accurately.

Here are some steps to building and using SQL business rules for the task:

Moving from manual to automated mortgage data extraction is a long-term process. Before you decide to bring in automated data extraction, assess if you have mortgage data extraction specialists onboard, and the budget to enable automation. Find out how well you can translate your mortgage processing knowledge into technology-led processing. How would you ensure that your drive to implement automation does not affect your customer services?

Having answers to these questions is important for creating a sustainable value across your mortgage processing chain. Remember, when you are ready to invest in mortgage automation, but lack direction, collaborate with mortgage documents data extraction experts.

What’s next? Message us a brief description of your project.

Our experts will review and get back to you within one business day with free consultation for successful implementation.

Disclaimer:

HitechDigital Solutions LLP and Hitech BPO will never ask for money or commission to offer jobs or projects. In the event you are contacted by any person with job offer in our companies, please reach out to us at info@hitechbpo.com