Optimize your financial AI and ML models with expert finance data labeling

Improve your AI and ML models to create a secure user experience by analyzing, prescribing & predicting outcomes with our financial data annotation services.

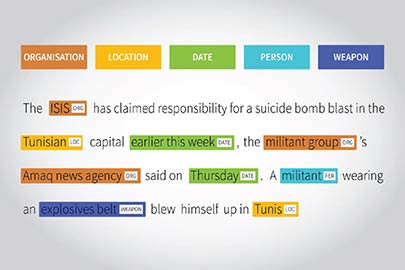

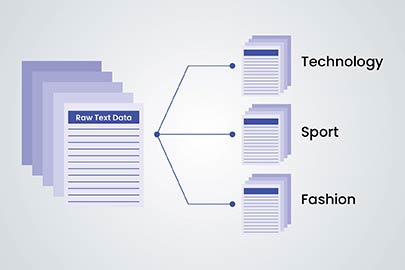

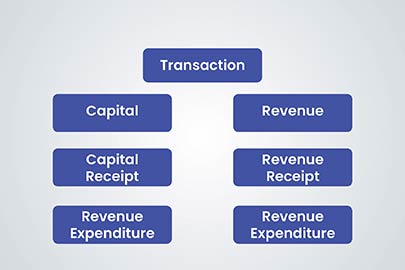

We at Hitech BPO, as the best financial data annotation company, Named Entity Recognition (NER), text categorization, sentiment annotation, transaction classification, and other data annotation services essential for building financial analysis models and ML algorithms.

Our specialist annotators understand the complexities of precise data annotation needed to train machine learning algorithms and AI models in the fintech sector. Our processes are backed by a team of experts who understand the nuances of tasks like fraud detection, credit risk analysis, customer behavior prediction, and personalized financial recommendations.

We specialize in annotating financial data that caters to the unique needs of your AI teams working to enhance financial analysis, risk assessment, and regulatory compliance. Our streamlined processes, expert staff, and technology, all come together to offer you customized services that enable comprehensive data analysis, risk assessment, fraud detection, and more.

Discuss your financial data annotation project with us »

We identify and categorize key financial entities like people, time, quantities, with high precision to enable automated data processing and information retrieval.

We organize text into specific categories for easier processing and analysis. This transforms unstructured data into structured formats for automated sorting of documents.

We classify transactions into groups, such as payments, deposits, fees, etc., for custom modeling and reporting in banking, credit processing, financial tracking and analysis.

We classify transactions into groups, such as payments, deposits, fees, etc., for custom modeling and reporting in banking, credit processing, financial tracking and analysis.

Gathering relevant financial documents and transaction data tailored to your project needs.

Employing advanced techniques for accurate labeling and categorization of financial data.

Rigorous quality checks to ensure high accuracy and reliability of annotated data.

Implementing stringent data security measures to protect the privacy and integrity of financial data.

Seamlessly integrating annotated data into fintech AI models for enhanced financial analysis and decision-making.

Data annotation services for various industries and domains.

We offer tailored solutions to meet specific requirements of AI models in the fintech sector, ensuring they are trained with relevant and accurate data.

Our services are scalable to handle large volumes of financial data and flexible to adapt to various annotation needs, ensuring efficiency in every project.

Whether it’s ML for financial analysis or AI in fraud detection, our experience ensures that we understand and meet your financial data annotation needs.

Our financial data annotation services are competitively priced, offering you high-quality solutions without compromising on accuracy or efficiency.

FAQs for Financial Data Annotation

What is financial data annotation and why is it important?

What types of financial data can be annotated?

How is financial data annotation used in AI development?

How much does financial data annotation cost?

How can I ensure the quality and accuracy of financial data annotation?

What’s next? Message us a brief description of your project.

Our experts will review and get back to you within one business day with free consultation for successful implementation.

Disclaimer:

HitechDigital Solutions LLP and Hitech BPO will never ask for money or commission to offer jobs or projects. In the event you are contacted by any person with job offer in our companies, please reach out to us at info@hitechbpo.com